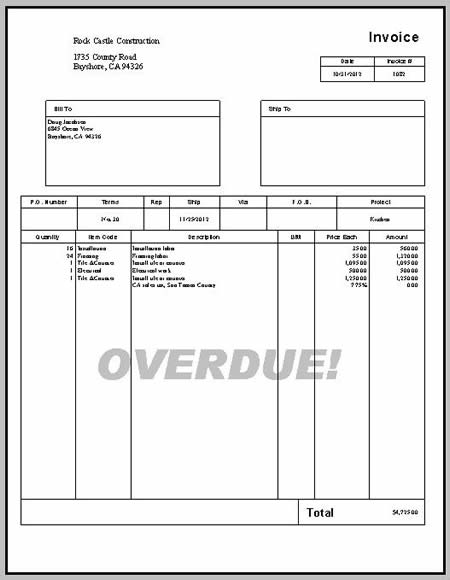

#FORCE PAYMENT OF OUTSTANDING INVOICES CODE#

Through the Prompt Payment Code (PPC), businesses are able to claim late payment interest and compensation to businesses signed up to the code if they miss a payment deadline. A change in payment culture is decades overdue”. We also need this to be top of the Board governance agendas. As well as customers and would-be employees we need to see potential investors refusing to invest in firms that don’t treat small suppliers well. Uncertainty kills small and micro businesses as well as freelancers and sole traders. Repeated delays and excuses, and extended payment terms of 90/120 and even 360 days are common. But late payments are just part of the problem. The consequences for wellbeing and mental health can be catastrophic. Small Business Commissioner, Liz Barclay, said: “We welcome the bank’s commitment to make bigger firms face up to the consequences of paying their small suppliers late. Business owners across the UK have a lot of challenges to juggle right now, and the stress of chasing late payments shouldn’t be one of them.” “Having a constant cycle of late payments will hamper the future growth of the economy, and fuel a never-ending cycle of uncertainty for hard working entrepreneurs.

#FORCE PAYMENT OF OUTSTANDING INVOICES HOW TO#

Any business worried about the impact of late payments should contact their bank to talk about their options, whether that be for guidance on how to report a business for paying late, or to explore invoice finance and insurance options. We want to unite the small business community in tackling this issue and raise the social conscience of larger businesses who don’t pay on time.

Hannah Bernard, Head of Business Banking at Barclays, said: “Late payments is the single biggest cause of business failure. Two fifths (39 per cent) of SME owners say their mental wellbeing has suffered as a result of late payments, with over a third (34 per cent) having had sleepless nights.Ī quarter (25 per cent) of business owners say they haven’t been able to go on holiday over the past couple of years because of money owed to their business, and a higher proportion (27 per cent) say their personal relationships with partners, family and friends worsen if they’re paid late. More than half of consumers surveyed (58 per cent) said they would boycott a business – big or small – if they knew they regularly paid their suppliers late.įor some business owners, the stress of waiting on late payments has more than just an impact on their finances. Whilst customers and clients paying invoices late is no new challenge for businesses, two in five (40 per cent) SMEs say that they’re more likely to experience late payments as a result of the pandemic.įor those that have been on the receiving end of poor payment practice, the majority (80 per cent) said they would refuse a job with a potential customer if they were known for paying late.īarclays research has shown that paying late is not only putting off suppliers, but may also deter prospective customers from spending with known offenders. In worst case scenarios, the business might be forced to close. For some businesses, this owed money might prevent new hiring opportunities or investment back into the business. Late payments negatively impact a business’s income, which can result in cash flow instability. Three in five (58 per cent) small or medium enterprises (SMEs) across the UK are currently waiting on late payments from customers, according to new research from Barclays surveying 500 small business owners.įor medium sized enterprises with 50 to 249 staff, those waiting on late payments rises to more than nine in ten (94 per cent).

Three in five (58%) SMEs are currently waiting on money which is tied up in unpaid invoices, according to research from Barclays 1.

0 kommentar(er)

0 kommentar(er)